Author: Dr. Jean-Paul Rodrigue

Petroleum remains a strategic resource in the global economy, underlining the challenges of producing and transporting oil.

[TO BE UPDATED]

1. Petroleum

Very few commodities have become as vital as petroleum since it can be used as a source of energy and a raw material in manufacturing plastics and fertilizers.

The barrel is the standard unit of measure for oil production and transportation volumes, even if it no longer has much concordance in reality (steel drums are sometimes used). Its usage has an unusual origin. In the 1860s, oil riggers were at a lossabout where to store the oil suddenly gushing out of new rigs. Empty whiskey barrels were used as a palliative and a convenient means to store and move oil for the emerging industry. Barrels have always been a convenient mode in a pre-motorized era since they could be manually handled by rolling them. By 1866, a standard barrel size of 42 US gallons (158.98 liters) was set.

As a commodity of strategic importance, petroleum has, for long, been the object of geopolitical confrontations. Several contemporary geopolitical events were closely related to oil or had consequences on oil supply and prices. The first event that triggered the geopolitical importance of oil was the decision in 1912 by the British Admiralty to convert its warships from coal to oil propulsion because of the speed and range advantages it conferred. Coal-powered ships required a network of coaling stations, limiting their operational flexibility. Since Britain had no oil resources, it nationalized the Anglo-Persian Oil Company and committed itself to protect this resource in Persia (Iran after 1934).

World War I underlined the growing importance of the internal combustion engine (trucks, tanks, and planes) in modern military operations. The 1920s were characterized by surging civilian demand for oil because as economies motorized; the automobile was becoming a significant mode of transportation. At the same time, the oil industry saw a rapid concentration and became controlled by a few major corporations that became the oil giants of today. The oligopolistic commercial control of the price and the production of oil was first established in 1928 by the Achnacarry Agreements between the “seven sisters”, the major oil multinationals of the time.

“Seven Sisters”. The seven major oil multinationals which by the early 20th century have achieved dominance over the industry. Five of them were American and the two others were British. The American companies included Exxon (Standard Oil of New Jersey), Mobil (Standard Oil of New York), and Socal (Standard Oil of California which later became Chevron), all of which were the result of the forced breakup of Standard Oil in 1911, and Gulf and Texaco which were created after the discovery of the Spindletop field in Texas in 1901. The British companies were Royal Dutch Shell (a joint venture with the Netherlands) and British Petroleum (BP), whose interest in world oil expanded with the discovery of oil fields in Persia (Iraq) and in the Dutch East Indies (Indonesia). Through mergers and acquisitions the “Seven Sisters” have become four; ExxonMobil, Chevron-Texaco, BP (acquired Amoco and Arco), and Royal Dutch Shell.

These corporations invested massively in extraction infrastructures, especially in the Middle East and Latin America. They were effectively in control of the world’s oil supply and demand with a set of strategies such as fixing quotas, prices, and production. However, a nationalization trend started to emerge in many developing countries, sowing the seeds of future oil supply control and shocks. In 1938 Mexico forcefully took control, through expropriation, of its entire oil industry, undermining for a while its access to foreign markets but triggering sympathy in many developing countries as a symbol against foreign exploitation of national resources.

World War II was revealed to be a conflict strategically dominated by oil as key weapons were armored and air forces. The decision of the United States to establish an oil embargo on Japan in 1941 was one event that triggered the war in the Pacific. Japan’s strategic objectives were to secure the resources of Southeast Asia, especially the oil fields of Indonesia, and have planned fast operations to achieve these objectives. The same year, Germany’s invasion of the Soviet Union had among its major objectives the securing of the oil fields around Baku in the Caucasus region. Both Germany and Japan failed to establish a secure source of oil, contributing to their defeat in 1945 by strategically more mobile allied forces. Allied nations controlled about 86% of the world’s oil supply.

The post World War II era underlined the growing geopolitical importance of the Middle East, as Europe and the United States were importing growing quantities of oil from that region. In 1948, the Ghawar Field was discovered in Saudi Arabia, which accounted for the largest conventional oil field in the world. The supply was shifting rapidly to the Middle East as more oil reserves were discovered, particularly around the Persian Gulf. Attempts were made to integrate countries like Iran, Iraq, and Saudi Arabia into alliances with Western powers. Still, a series of geopolitical events, such as the creation of the OPEC and Islamic nationalisms, would complicate access to oil resources. Changes in oil prices are commonly the outcome of two main factors. The first is disruptive geopolitical events such as wars and revolutions, while the second is related to changes in the demand for oil, such as phases of growth and recessions. Both drivers are often interrelated.

2. The Geopolitics of Petroleum

Given the powerful economic control of oil production by Western multinational corporations (the Seven Sisters), several producing countries, most of them in the Middle East, had a goal to gather a greater share of the oil incomes by controlling supply. Venezuela, Iran, Iraq, Saudi Arabia, and Kuwait founded the Organization of Petroleum Exporting Countries (OPEC) in 1960 at the Baghdad conference. From its foundation until the beginning of the 1970s, the OPEC was unable to increase oil prices. The main reasons were that production was very important in non-member countries and because of the difficulty of OPEC members to agree on a common policy since economic theory clearly underlines that cartels are not effective at fixing prices. Consequently, developed countries were confident that the price of petroleum would remain relatively stable. In the United States, oil prices were regulated and subject to little fluctuations. In such an environment of low petroleum prices and strong economic growth, no developed country had an energy policy, and energy waste was common.

In the 1970s, OPEC countries achieved control over more than 55% of the global oil supply and started to fix production quotas based on the oil reserves of each of its members. Each member began a process of nationalization of their oil industry (Libya, 1971; Iraq, 1972; Iran, 1973; Venezuela, 1975). By 1972, 25% of the ownership of oil operations in OPEC countries was nationalized, a figure that climbed to 51% by 1983. Another objective was to establish cooperation between producers in order to avoid competition that would bring prices down. This cartel objective was feasible in the context of growing market demand and the dependency on only a few oil suppliers, but very difficult to maintain in a competitive environment. However, the initial trigger of the surge in oil prices in the 1970s was a monetary event. In 1971, the United States decided to “close the gold window” essentially removing the convertibility of the US dollar in gold. The dollar thus became a fiat currency, only backed up by confidence in the American economy. Strong inflationary pressures thus began, as this event essentially became a “license to print”, which quickly percolated into commodity prices, including oil. Between 1970 and 1973, oil prices jumped from $1.80 to $3.29 per barrel as OPEC countries adjusted their price to reflect the American inflationary monetary policy. Further, by the early 1970s, the United States was running out of spare capacity in its domestic oil production. It became increasingly reliant on imports that were subject to global market prices.

The Kippur War between Israel and Egypt (and several other Arabian countries) in 1973 gave OPEC additional reasons to intervene by nationalizing production facilities, reducing production by 25%, and imposing export quotas. The goal was to undermine Israel’s support, mainly by the United States, but also achieve an oil price structure more reflective of the economic conditions of rapid growth and inflation. Oil became a geopolitical weapon. On October 19, 1973, OPEC declared an oil embargo against the United States, which lasted until June 1974. The price of oil consequently climbed to $12 per barrel by the end of 1973, a fourfold increase. In a context of high oil demand, limited additional capacity in developed countries, and no readily energetic substitutes, OPEC gained the temporary ability to control the price of oil. The market became controlled by supply (oil producers), causing the first oil shock.

Under the control of OPEC, the price of oil remained high but stable from 1974 to 1978, around $12 per barrel. Developed countries started to worry about the exhaustion of oil reserves and unreliable supply sources, but not much was done in this regard. The Iranian revolution of 1979 and the ensuing Iran-Iraq War (1980-1988) were associated with the second oil shock, where the price of oil surged over $35 per barrel. Geopolitical uncertainties and ongoing growth of the demand created an environment of expectations of higher oil prices. These new market conditions imposed several drastic, but somewhat temporary, measures to lower oil consumption. It resulted in a relocation of energy-consuming industries, in strategies for consuming less energy (such as energy-efficient cars and appliances), in relying more on national energy sources (petroleum, coal, natural gas, hydroelectricity, nuclear energy), in building strategic reserves, and in substituting petroleum for other energy sources when possible. It is estimated that about 2 billion barrels are held in strategic reserves around the world, the bulk of them in the United States, Japan, and Germany. The Carter Doctrine (1980) stated that the United States would intervene militarily if its oil supply was compromised, which is also the outcome of the uncertainties derived from the first and second oil shocks. The military presence of the United States in the Middle East was increased, as the oil of the Persian Gulf was clearly perceived as of foremost importance to national security.

In 1980, a shift in monetary policy (tightening of monetary supply and an increase in interest rates) and a global recession lowered oil demand expectations. From 1982, divergences occurred within OPEC members to fix quotas and prices as competition increased. Furthermore, the share of OPEC dropped from 55% of all the petroleum exported in the 1970s to 42% in 2000, with an all-time low of 27% in 1985. That year, Saudi Arabia lowered its oil price to increase its market share while OPEC members were competing with each other to be allotted larger quotas. A decision was made to allocate quotas in proportion to proven oil reserves, leading to an array of “creative accounting” practices in the estimation of reserves. Thus, reserves were indexed to fit production needs, leaving doubts about their true extent. For instance, Kuwait’s reserves surged from 64 to 92 billion barrels in just one year and without any new discoveries. The reserves of the United Arab Emirates were boosted from 31 to 92 billion barrels. Iran announced that its real reserves were 93 billion barrels, up from 47 billion barrels. The most significant “increase” in oil reserves in 1985 came from Iraq when its reserves went to 100 billion barrels, up from the previous 47 billion barrels. Those inflated reserve figures remain today. The result of this inflation of reserves and the larger export quotas they permitted was an oil counter-shock that lowered the barrel price under 20 dollars, even reaching a record low of 15 dollars in 1988. The oil market was again a market controlled by the demand.

At the end of the 1980s and the beginning of the 1990s, OPEC countries lost their price-fixing power because of internal problems (economic and geopolitical conflicts between its members) and especially with the arrival of new producers such as Russia, Mexico, Norway, the United Kingdom, and Colombia. The higher oil price in the early 1980s incited large investments in exploration and new production, which started to become available by the mid-1980s. These new producers were not subject to OPEC policies and were free to fix their prices. Mexico, for instance, surpassed Saudi Arabia in 1997 to become the second-largest oil exporter to the United States. Latin American countries such as Columbia and Brazil boosted their oil production. Vietnam explored offshore fields, as are other Southeast Asian countries, hopeful that there are major reserves under the South China Sea. Henceforth, OPEC countries maintained control of about 40% of global oil production. In the current setting, OPEC can be considered as a dysfunctional cartel. Formal price fixing mechanisms, both on the supply and demand sides, commonly fail as there are too many incentives not to abide, mainly if oil prices are different from expectations.

Abiding by production quotas became a major issue among OPEC members, with Kuwait producing well above quota. This transgression was a motivation, among others, for the invasion of Kuwait by Iraq in 1990, triggering the First Gulf War (1990-1991). The biggest concern was the possible invasion of Saudi Arabia and the resulting massive disruptions in oil production. The market reacted to these uncertainties, and the price of petroleum jumped to $23 per barrel. The United States applied the Carter Doctrine and intervened with a massive military operation, which ousted Iraqi forces of Kuwait. Then, an oil embargo on Iraq was established by the United Nations. However, other petroleum-exporting countries were quick to expand their production to replace Iraq’s and Kuwait’s shortfalls, and the price of oil fell to $15 per barrel by the end of the 1990s. In 1997, the Asian Financial Crisis and its impacts in other parts of the world created a deflationary pressure on oil prices, which lasted until 2000.

The beginning of the 21st century saw increased insecurities in oil supply, political pressures, monetary debasement, and military interventions; a third oil shock unfolded between 2003 and 2008. The Second Gulf War (2003) saw the American occupation of Iraq. The outcome was greater control of long term petroleum supply sources but with increasing political instability in the Middle East. Oil output from Iraq, which accounts for the fourth-largest reserves in the world, has remained problematic. Additionally, instability in Venezuela (corruption and nationalization) and Nigeria (civil unrest), have stretched the world’s extra capacity. Increased demands from developing economies, mainly from China, which became by then the world’s second-largest importer, also placed significant pressures on global oil supplies. This ongoing demand pressure resulted in expectations of higher oil prices through the 2000s. Several large oil fields, such as the North Sea and producers started to experience a decline in their output, adding concerns about the capacity of the existing reserves to meet market demand. Further, the debasement of the US dollar by the monetary policies of the Federal Reserve was also contributing to higher oil prices through inflationary pressures also followed by the European Central Bank and the Central Bank of China. Attempts at mitigating the consequences of an asset inflation phase triggered by accommodating credit creation policies have spilled over the commodity and energy sectors that became the focus of speculative investments. Unlike the first two oil shocks, the third oil shock was related to an unhealthy mix of strained supplies, geopolitical risk, and monetary debasement.

By 2008, oil prices peaked $130 per barrel, underlining the speculative characteristics that segments of the oil market had become. The same year, a global financial crisis unfolded and triggered a major global recession. Demand expectations were quickly revised, and the price of oil collapsed to $40 per barrel. This collapse was perceived as an overreach as soon as the financial system stabilized in 2010, oil prices bounced back to the $80 to $100 per barrel range and remained as such through the 2010s. In 2011, events related to the ‘Arab Spring’ led to political unrest in parts of the Middle East and North Africa, such as the Libyan revolution and civil war in Syria, added to geopolitical risks. This new price level incited substantial investments in alternative sources of energy and non-conventional sources such as oil sands and shale oil. Producers in decline, such as the United States, Canada, and Russia, even saw a growth in domestic oil production. By 2014, growth in tar sands and oil shale output combined with a global economic slowdown and the growing share of alternative sources of energy such as wind, solar, and biofuels, triggered a counter-shock in oil prices to around $50 per barrel. In this new environment, there are fewer concerns about the supply and availability of oil on global markets. Market and geopolitical considerations for strategic resources such as oil continue to underline volatility that is difficult to predict, implying the recurring presence of shocks and counter-shocks.

3. Petroleum Supply and Demand

The oil industry is oligopolistic both in its supply, demand, control, and in its functional and geographical concentration. The demand is controlled by a few very large multinational conglomerates, each having a production and distribution system composed of refineries, storage facilities, distribution centers, and at the end of the supply chain, gas stations. The supply is controlled by a few countries where the oil industry is often nationalized or subject to OPEC cartel rules, regulating about 35% to 40% of the global oil production. There are numerous challenges facing the global oil industry in terms of additional capacity, refining capacity, and its distribution through a system of pipelines and tankers.

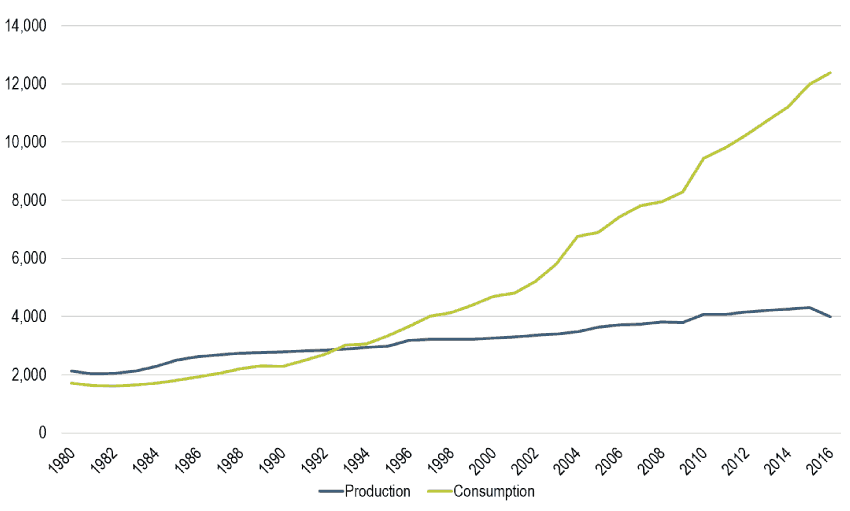

Since the first commercial exploitation in Pennsylvania in 1859, the importance of oil has increased significantly in the global economy. In 1920, 95 million tons of oil were produced annually around the world. This number reached 500 million tons by 1950, a billion tons in 1960, and an average annual production of around 3 and 4 billion tons in the 1990s and 2010s. This strong growth rests largely on the availability of oil resources and their low cost. Like many other resources, petroleum reserves are subject to variations related to discoveries and what can be economically extracted. Continuous technological innovations in surveying and extraction technologies enabled to discover and economically exploit oil resources in previously inaccessible locations. This is particularly the case for the arctic and subarctic environmental conditions (e.g. Alaska and Siberia) or offshore locations (e.g. North Sea).

A. Reserves

Oil reserves have a high concentration level, with 64% of proven reserves located in the Middle East. The question remains about how much reserves of oil are available and how much time they would last. Figures about the totality of earth’s oil reserves were between 2,100 and 2,800 billion barrels before oil began to be exploited in the 19th century. As of 2016, an estimated 1,700 billion barrels of proved oil reserves were available, and 900 billion barrels have been extracted, which represents about a third of all known oil reserves. To this figure, it can be added between 200 to 900 billion barrels of oil that potentially remain to be found. Considering these figures, global oil production should peak around 2015-2020 and then start to decline.

This trend is being confirmed by the output of the world’s largest oil fields, all of which are either in decline or possibly declining, in addition to an ongoing decline in several oil-producing regions in the West. From a long-term perspective, the control of OPEC may emerge again since the bulk of oil reserves is located within its jurisdiction. Saudi Arabia alone has about 25% of the world’s oil reserves, putting upward pressure on energy prices. However, there is a potential for tapping tar sands (particularly in Canada) to produce oil, but this process is energy-intensive and leads to low-quality fuels.

B. Supply

Oil production steadily increased in the second half of the 20th century to satisfy growing demand. On average, 92.1 million barrels of crude oil are produced each day (2016 figures), 32% of it in the Middle East, the single most important oil-producing region in the world. About 60% of all the oil being produced is already committed, and 40% is sold on open markets. More significantly, excess oil production is limited both in capacity and in its geographical origin. 90% of this excess oil production is located in the Persian Gulf with Saudi Arabia, along with accounting for the world’s largest oil reserves, is the only major supplier able to provide instant additional capacity if required. Excess production capacity is of high relevance as if a major disruption in other suppliers occurs. The additional capacity can immediately be brought up to maintain the current oil supply level without significant price disruptions. Recent events, namely the conflict in Iraq, nationalization in Venezuela, and civil unrest in Nigeria, have increased uncertainty for oil supplies.

C. Demand

Demand. An average of 96.5 million barrels of petroleum per day was consumed (2016 figures), compared with 31.2 million barrels in 1965. Economic systems, including industry, housing, energy generation, and transportation, became dependent on cheap oil prices, with the United States being the most eloquent example. While the United States ranks as the leading global consumer of oil (19.6 Mb/d), the rapid growth of the Chinese economy in the last decade has propelled China to the second rank of oil consumers (12.4 Mb/d). China accounted for around 40% of the global growth in oil demand in recent years. Since transportation activities consume 55% of all oil (figure much higher in advanced economies), motorization is one of the driving forces behind the consumption of petroleum. Demand is also characterized by seasonality, with heating oil demands in the winter and more gasoline demands in the summer.

D. Supply / Demand Relationships

There are also concerns that at the same time that global oil production could be leveling off and eventually decline that exports could drop at a higher rate because of growing domestic consumption in oil-producing countries. Thus, potentially dwindling supply and increasing demand could create multiplying effects. This trend applies well to the United States, China, and Indonesia, which have shifted from being net exporters to become net importers. For many other cases, oil consumption has not changed significantly over time. Yet, new technologies and the development of new domestic oil resources can impact this trend. In recent years, both the level and origin of American oil imports have substantially changed, underlining a level of flexibility in oil sourcing strategies that a nation can pursue.

An overview of the geography of oil production and consumption thus underlines a strong spatial differentiation between supply and demand because of geographical and geological factors. Oil is mainly produced in different locations from where it is consumed, resulting in acute geographical imbalances. These imbalances can only be overcome by massive oil transportation infrastructures, including pipelines, tankers, and storage facilities.

Related Topics

- Transborder and Crossborder Transportation

- Maritime Transportation

- Transportation and Energy

- Freight Transportation and Value Chains

- Transportation and Commercial Geography

Bibliography

- Zavitsas, K (2011) The Vulnerability of the Petroleum Supply Chain. London: Imperial College London.